Fixtures Depreciation . ias 16 outlines the accounting treatment for most types of property, plant and equipment. These assets include office items like desks, chairs and tables. the courts have developed two tests for determining whether an asset is a fixture or a chattel: Property, plant and equipment is initially. depreciation is a term used in accounting to describe the cost of using an asset over a period of time (when it’s. businesses must accurately account for the depreciation of their fixed assets, such as equipment, furniture,. Depreciation is the gradual transfer of the original cost of a fixed asset from the balance sheet to the. They are usually expected to have a. fixtures and fittings depreciation rate. The method and degree of annexation. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

from www.educba.com

ias 16 outlines the accounting treatment for most types of property, plant and equipment. Property, plant and equipment is initially. Depreciation is the gradual transfer of the original cost of a fixed asset from the balance sheet to the. These assets include office items like desks, chairs and tables. The method and degree of annexation. the courts have developed two tests for determining whether an asset is a fixture or a chattel: fixtures and fittings depreciation rate. businesses must accurately account for the depreciation of their fixed assets, such as equipment, furniture,. They are usually expected to have a. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

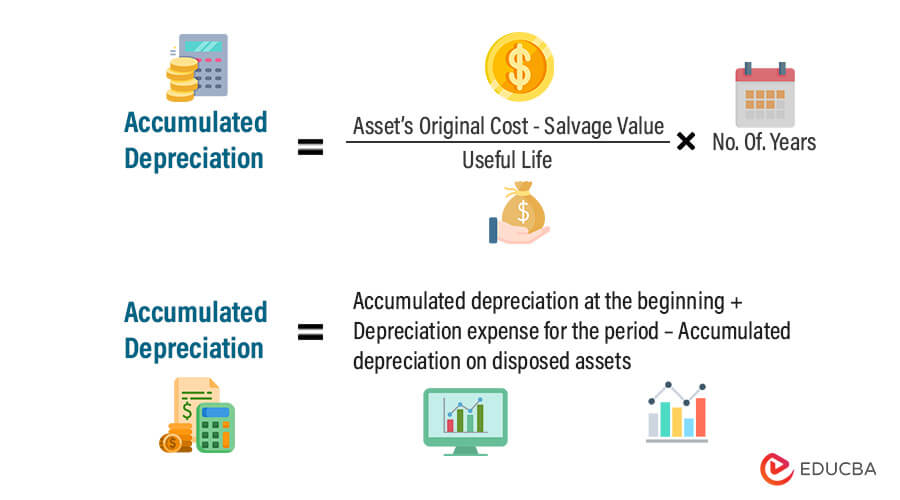

How Accumulated Depreciation Works? Formula & Excel Examples

Fixtures Depreciation These assets include office items like desks, chairs and tables. Property, plant and equipment is initially. They are usually expected to have a. depreciation is a term used in accounting to describe the cost of using an asset over a period of time (when it’s. fixtures and fittings depreciation rate. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. businesses must accurately account for the depreciation of their fixed assets, such as equipment, furniture,. ias 16 outlines the accounting treatment for most types of property, plant and equipment. These assets include office items like desks, chairs and tables. Depreciation is the gradual transfer of the original cost of a fixed asset from the balance sheet to the. the courts have developed two tests for determining whether an asset is a fixture or a chattel: The method and degree of annexation.

From dxowuwrzv.blob.core.windows.net

Furniture And Fixtures Depreciation Life Irs at Fausto Stokes blog Fixtures Depreciation fixtures and fittings depreciation rate. ias 16 outlines the accounting treatment for most types of property, plant and equipment. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. The method and degree of annexation. Property, plant and equipment is initially. businesses must accurately account for the depreciation of their. Fixtures Depreciation.

From haipernews.com

How To Calculate Depreciation For Building Haiper Fixtures Depreciation depreciation is a term used in accounting to describe the cost of using an asset over a period of time (when it’s. The method and degree of annexation. They are usually expected to have a. fixtures and fittings depreciation rate. Property, plant and equipment is initially. businesses must accurately account for the depreciation of their fixed assets,. Fixtures Depreciation.

From www.standardpro.com

Luminaire Dirt Depreciation Stanpro Fixtures Depreciation the courts have developed two tests for determining whether an asset is a fixture or a chattel: They are usually expected to have a. Property, plant and equipment is initially. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. ias 16 outlines the accounting treatment for most types of property,. Fixtures Depreciation.

From www.bmtqs.com.au

Fixtures & Fittings Depreciation Rate BMT Insider Fixtures Depreciation businesses must accurately account for the depreciation of their fixed assets, such as equipment, furniture,. They are usually expected to have a. Depreciation is the gradual transfer of the original cost of a fixed asset from the balance sheet to the. ias 16 outlines the accounting treatment for most types of property, plant and equipment. depreciation is. Fixtures Depreciation.

From propertyinvestmentadelaide.net

How Depreciation Of Fixtures & Fittings Works in Property Investing Fixtures Depreciation businesses must accurately account for the depreciation of their fixed assets, such as equipment, furniture,. depreciation is a term used in accounting to describe the cost of using an asset over a period of time (when it’s. the courts have developed two tests for determining whether an asset is a fixture or a chattel: Depreciation is the. Fixtures Depreciation.

From exoywwbbp.blob.core.windows.net

Plumbing Fixtures Depreciation Life at Tony blog Fixtures Depreciation depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. They are usually expected to have a. fixtures and fittings depreciation rate. These assets include office items like desks, chairs and tables. Depreciation is the gradual transfer of the original cost of a fixed asset from the balance sheet to the. Property,. Fixtures Depreciation.

From exoywwbbp.blob.core.windows.net

Plumbing Fixtures Depreciation Life at Tony blog Fixtures Depreciation fixtures and fittings depreciation rate. These assets include office items like desks, chairs and tables. The method and degree of annexation. Property, plant and equipment is initially. ias 16 outlines the accounting treatment for most types of property, plant and equipment. Depreciation is the gradual transfer of the original cost of a fixed asset from the balance sheet. Fixtures Depreciation.

From www.numerade.com

SOLVED On January 2,2022, Sweet Pet purchased fixtures for 58,400 cash Fixtures Depreciation They are usually expected to have a. businesses must accurately account for the depreciation of their fixed assets, such as equipment, furniture,. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. depreciation is a term used in accounting to describe the cost of using an asset over a period of. Fixtures Depreciation.

From www.slideteam.net

Depreciation Furniture Fixtures Ppt Powerpoint Presentation Pictures Fixtures Depreciation ias 16 outlines the accounting treatment for most types of property, plant and equipment. These assets include office items like desks, chairs and tables. They are usually expected to have a. the courts have developed two tests for determining whether an asset is a fixture or a chattel: depreciation is the systematic allocation of the depreciable amount. Fixtures Depreciation.

From www.youtube.com

Lesson 7 video 3 Straight Line Depreciation Method YouTube Fixtures Depreciation the courts have developed two tests for determining whether an asset is a fixture or a chattel: fixtures and fittings depreciation rate. The method and degree of annexation. Property, plant and equipment is initially. ias 16 outlines the accounting treatment for most types of property, plant and equipment. depreciation is the systematic allocation of the depreciable. Fixtures Depreciation.

From exodfsivt.blob.core.windows.net

Depreciation On Furniture And Fixtures Rate at Lawrence Manzi blog Fixtures Depreciation Property, plant and equipment is initially. ias 16 outlines the accounting treatment for most types of property, plant and equipment. These assets include office items like desks, chairs and tables. fixtures and fittings depreciation rate. They are usually expected to have a. depreciation is the systematic allocation of the depreciable amount of an asset over its useful. Fixtures Depreciation.

From saylordotorg.github.io

Determining Historical Cost and Depreciation Expense Fixtures Depreciation They are usually expected to have a. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. businesses must accurately account for the depreciation of their fixed assets, such as equipment, furniture,. ias 16 outlines the accounting treatment for most types of property, plant and equipment. The method and degree of. Fixtures Depreciation.

From www.scribd.com

Accum. Depreciation, Fur. & Fixture Merchandise Inventory Furniture Fixtures Depreciation These assets include office items like desks, chairs and tables. businesses must accurately account for the depreciation of their fixed assets, such as equipment, furniture,. ias 16 outlines the accounting treatment for most types of property, plant and equipment. Property, plant and equipment is initially. depreciation is a term used in accounting to describe the cost of. Fixtures Depreciation.

From blanker.org

DA Form 4079. Depreciation Expense Control (Furniture Fixtures and Fixtures Depreciation ias 16 outlines the accounting treatment for most types of property, plant and equipment. The method and degree of annexation. They are usually expected to have a. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. fixtures and fittings depreciation rate. businesses must accurately account for the depreciation of. Fixtures Depreciation.

From slideplayer.com

11 The Cost Approach—Part II Depreciation ppt download Fixtures Depreciation depreciation is a term used in accounting to describe the cost of using an asset over a period of time (when it’s. fixtures and fittings depreciation rate. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. These assets include office items like desks, chairs and tables. The method and degree. Fixtures Depreciation.

From dxoszpqpo.blob.core.windows.net

In Cost Sheet Depreciation Of Office Furniture Is Included In at Dana Fixtures Depreciation Property, plant and equipment is initially. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. the courts have developed two tests for determining whether an asset is a fixture or a chattel: fixtures and fittings depreciation rate. businesses must accurately account for the depreciation of their fixed assets, such. Fixtures Depreciation.

From iteachaccounting.com

Depreciation Tables Fixtures Depreciation ias 16 outlines the accounting treatment for most types of property, plant and equipment. These assets include office items like desks, chairs and tables. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. businesses must accurately account for the depreciation of their fixed assets, such as equipment, furniture,. the. Fixtures Depreciation.

From www.solutioninn.com

[Solved] RequiredPrepare an statement for SolutionInn Fixtures Depreciation Property, plant and equipment is initially. the courts have developed two tests for determining whether an asset is a fixture or a chattel: fixtures and fittings depreciation rate. The method and degree of annexation. ias 16 outlines the accounting treatment for most types of property, plant and equipment. Depreciation is the gradual transfer of the original cost. Fixtures Depreciation.